JNK India, a Maharashtra-based company specializing in the design and manufacturing of processed-fired heaters, recently made headlines with its remarkable stock debut. On April 22, the company raised Rs 194.84 crore through an anchor book, setting the stage for its entry into the stock market.

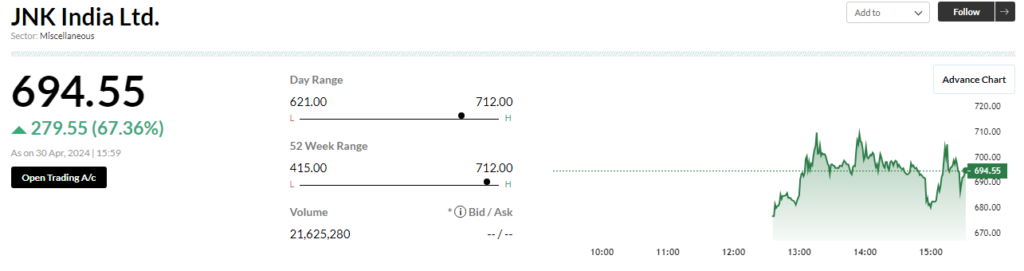

Exceptional Stock Debut

The market was pleasantly surprised as JNK India’s shares surpassed expectations, debuting with a 50 percent gain on the bourses. This surge in share value reflects the investor interest generated by the company’s Rs 649.47-crore public offer, which was oversubscribed 28.13 times, showcasing the confidence investors have in JNK India’s growth potential.

Positive Analyst Outlook

Analysts have expressed a positive outlook on JNK India’s stock, citing multiple growth catalysts for the company. Prashanth Tapse, Senior Vice President at Mehta Equities, recommends conservative investors to book profits while suggesting long-term holding for risk-taking investors. The strategic expansion into waste gas handling and renewable energy systems demonstrates JNK India’s adaptability and proactive approach to capitalize on emerging market opportunities.

Financial Performance

Despite a slight decline in the nine months ending December 2023, where the return on equity (ROE) and return on capital employed (ROCE) stood at 28 and 27 percent respectively, JNK India’s financial performance remains robust. Over the three years from FY21 to FY23, the company achieved an impressive average ROE of 53 percent and ROCE of 58 percent, underscoring its profitability and efficiency.

Strategic Collaboration and Market Position

JNK India benefits from a strategic collaboration with JNK Global, one of its promoters, which commands a 16 percent global market share in the heating equipment segment. Moreover, the industry’s high entry barriers, characterized by stringent quality norms and high switching costs, fortify JNK India’s market position and limit competition, ensuring sustained growth and profitability.

Revenue and Profit Growth

In FY23, JNK India witnessed a significant increase in revenue, reaching Rs 407.32 crore, with the oil and gas segment contributing 77 percent of total revenue. The company’s net profit for the fiscal year amounted to Rs 46.36 crore, reflecting its ability to capitalize on market opportunities and deliver consistent financial performance.

Future Growth Drivers

Analysts highlight several factors that are expected to drive JNK India’s future growth. With a healthy order book worth Rs 850 crore and a high total addressable market (TAM) in both India and overseas, the company enjoys revenue visibility and growth prospects. Additionally, JNK India’s strategic diversification into product categories for various industries and its increased geographical presence in high-growth markets position it well to capitalize on emerging opportunities and maintain a consistent order inflow.

JNK India’s exceptional stock debut and promising growth prospects underscore its potential as a lucrative investment opportunity in the heating equipment segment. With a strong financial track record, strategic collaborations, and a proactive approach to market expansion, JNK India is well-positioned to capitalize on evolving market dynamics and deliver sustainable value to its stakeholders.