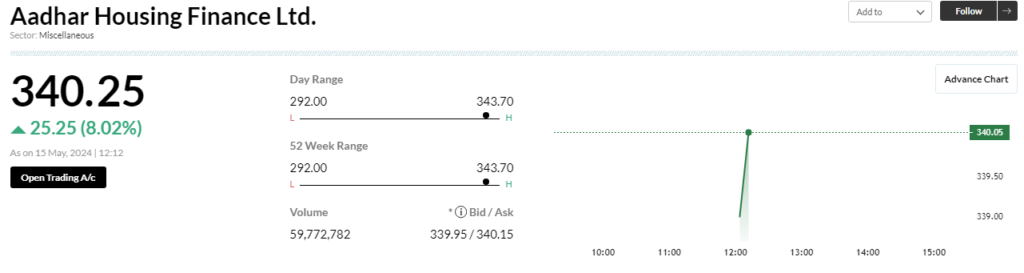

Aadhar Housing Finance, a company carving a niche in the low-income housing sector, made its much-anticipated debut on Indian stock exchanges on [Date]. While the initial listing price hovered near the IPO price (₹314.30 on BSE and ₹315 on NSE), the stock witnessed a positive swing throughout the day, reaching an intraday high of ₹341.95 on both exchanges. This uptick has ignited interest among investors, prompting a closer look at Aadhar’s potential and long-term prospects.

A Unique Player in the Housing Finance Market

Unlike traditional housing finance companies that primarily cater to middle and high-income segments, Aadhar Housing Finance stands out for its specialization in low-income housing. This segment, characterized by “economically weaker sections” and “middle-to-low income” individuals, represents a vast and underserved market in India. As government initiatives like “Housing for All” and granting infrastructure status to affordable housing gain momentum, the low-income housing sector is projected to be the fastest-growing within the entire housing finance industry.

This strategic focus on a burgeoning market segment appears to be a key factor attracting investor interest. Experts like Prashanth Tapse, Senior VP of Research at Mehta Equities, acknowledge that while the listing price fell slightly below some initial expectations, the company’s niche focus has garnered significant attention. He highlights the “decent subscription demand” during the IPO as proof of this growing interest.

Reasonable Valuation and Solid Financials: A Recipe for Long-Term Growth

Another factor drawing investors to Aadhar Housing Finance is its relatively reasonable valuation. Compared to industry peers, the company’s initial stock price is perceived as fair and attractive. This is crucial, especially in today’s volatile market conditions. As Amit Goel, Co-Founder & Chief Global Strategist at Pace 360, points out, Aadhar’s pricing strategy positions it well for future growth. He emphasizes the company’s focus on “small-ticket mortgage loans” targeted at low-income buyers, a market segment with immense potential.

Aadhar’s financial health further strengthens its case as a promising long-term investment. Shreyansh Shah, a Research Analyst at StoxBox, highlights the company’s impressive return on equity (ROE) of 15.9% in FY23, the second-highest in the industry. He anticipates further improvement in operational performance driven by factors like their dominant presence in the low-income housing segment, lower borrowing costs, and high return ratios compared to competitors.

Adding to the company’s appeal are its sound financial practices. Aadhar boasts a stable average ticket size for loans, indicating a well-defined customer base and a controlled risk profile. Furthermore, their increasing penetration into Tier 4 and Tier 5 towns signifies a strategic expansion plan aimed at tapping into a wider customer pool and fueling further growth.

Expert Recommendations: A Long-Term Play with Potential Rewards

Considering the company’s unique market focus, reasonable valuation, and robust financial health, stock market experts are recommending a long-term perspective for investors. Here’s a breakdown of their key insights:

- Prashanth Tapse (Mehta Equities): He acknowledges the subdued market conditions but believes Aadhar’s long-term prospects are bright. He recommends holding the stock, especially for conservative investors seeking a valuable addition to their portfolio.

- Amit Goel (Pace 360): He reiterates the company’s specialization in low-income housing and its potential for future growth. He advises investors to consider the stock’s potential for medium to long-term rewards.

- Shreyansh Shah (StoxBox): He highlights Aadhar’s strong financial performance and anticipates further improvement. He recommends holding the shares for a medium to long-term perspective, especially for those who received allotments during the IPO.

Beyond the Initial Hype: Factors to Consider

While the initial market response to Aadhar Housing Finance is positive, investors should conduct their own due diligence before making investment decisions. Here are some additional factors to consider:

- Overall Market Conditions: The stock market is inherently volatile. While the low-income housing sector presents long-term potential, economic fluctuations and market movements can impact the stock price in the short term.

- Regulatory Changes: Government policies and regulations in the housing finance sector can affect Aadhar’s operations. Staying informed about any policy changes is crucial.

- Competition: The low-income housing segment is attracting new players. Monitoring Aadhar’s competitive landscape and its ability to maintain its market share is important.

- Company Execution: Aadhar’s future success hinges on its ability to effectively execute its expansion plans and maintain its financial strength. Tracking the company’s performance and growth metrics is essential.

A Look Ahead: Potential Risks and Opportunities for Aadhar Housing Finance

While the outlook for Aadhar Housing Finance appears promising, there are potential risks and opportunities that investors should be aware of:

Potential Risks:

- Macroeconomic Challenges: India’s economic growth can significantly impact the housing sector. Rising interest rates, inflation, and economic slowdowns could dampen demand for home loans in the low-income segment, affecting Aadhar’s loan disbursements and profitability.

- Credit Quality Concerns: Catering to the low-income segment comes with inherent risks of loan defaults. Aadhar’s stringent credit assessment processes and effective loan collection mechanisms will be crucial in mitigating these risks.

- Operational Challenges: Expanding into Tier 4 and Tier 5 towns presents logistical challenges in loan processing, customer service, and collection activities. Aadhar’s ability to scale its operations efficiently and address these challenges will be critical.

- Regulatory Burden: Government regulations regarding loan eligibility, interest rates, and other parameters can impact Aadhar’s profitability and growth strategy. Staying compliant and adapting to any regulatory changes will be essential.

Potential Opportunities:

- Government Initiatives: Government schemes like “Housing for All” and subsidies for low-income housing can create significant demand for home loans within Aadhar’s target segment. Effectively leveraging these initiatives can propel the company’s growth.

- Financial Inclusion: Expanding financial inclusion efforts in rural and underbanked areas can open up a vast customer base for Aadhar. Partnerships with banks and digital payment platforms can further enhance their reach.

- Product Diversification: Beyond traditional home loans, Aadhar can explore offering additional products like renovation loans, property insurance, and micro-investment options tailored to the needs of low-income borrowers. Diversifying their product portfolio can create new revenue streams.

- Technological Innovation: Embracing technology to streamline loan processing, customer onboarding, and collection activities can improve operational efficiency and reduce costs for Aadhar. Leveraging digital platforms can also enhance customer service and improve access to financial services in remote areas.

A Well-Positioned Player with Long-Term Potential

Aadhar Housing Finance’s focus on the underserved low-income housing segment, coupled with its reasonable valuation and sound financial health, positions it as a compelling investment opportunity for investors seeking long-term growth. However, careful consideration of potential risks and an awareness of exciting opportunities are crucial for making informed investment decisions. As the Indian housing market evolves and government initiatives gain momentum, Aadhar Housing Finance stands poised to capitalize on the burgeoning low-income housing sector and establish itself as a key player in this space. By effectively navigating challenges and seizing emerging opportunities, Aadhar can deliver value to its investors and fulfill its mission of empowering individuals to achieve their dream of homeownership.

Aadhar Housing Finance: FAQs

Q: What is Aadhar Housing Finance?

A: Aadhar Housing Finance is a unique company specializing in home loans for low-income buyers in India.

Q: Why is Aadhar’s stock price interesting?

A: Aadhar focuses on a fast-growing market segment (low-income housing) and has a reasonable valuation compared to competitors.

Q: What are the experts saying about Aadhar?

A: Experts recommend a long-term hold due to Aadhar’s strong financials, reasonable valuation, and potential for growth in the low-income housing sector.

Q: Are there any risks to consider?

A: Yes, potential risks include macroeconomic challenges, credit quality concerns, operational challenges in expanding to smaller towns, and changes in government regulations.

Q: What are some potential opportunities for Aadhar?

A: Government initiatives promoting affordable housing, financial inclusion efforts, product diversification, and technological innovation can all fuel Aadhar’s growth.