In a remarkable turnaround, Adani Enterprises Ltd., the flagship company of Indian billionaire Gautam Adani, has clawed its way back from a scathing short-seller report in early 2023. The company’s stock price has not only recovered all the losses it suffered but has nearly tripled since its lowest point, erasing the doubts raised by Hindenburg Research.

This comeback story is a testament to Adani’s resilience and its efforts to navigate a challenging period. Let’s delve deeper into the events that unfolded.

A Scathing Report and Investor Jitters:

In January 2023, Hindenburg Research, a US-based short-seller firm, released a report accusing the Adani Group of “brazen stock manipulation and accounting fraud over the course of decades.” The report sent shockwaves through the Indian stock market, causing a sharp decline in the share prices of all Adani companies. Adani vehemently denied the allegations, but the damage was done. Investor confidence took a hit, and billions of dollars were wiped off the group’s market value.

Debt Reduction and Strategic Moves:

Faced with this crisis, Adani adopted a multi-pronged approach. Recognizing the concerns about debt levels, the group focused on reducing its financial obligations. This involved strategic asset sales and a renewed focus on cash flow generation. Additionally, Adani secured major projects across various sectors, showcasing its commitment to growth and profitability.

This proactive approach instilled confidence in investors. The tide began to turn in March 2023 when GQG Partners, a prominent investment firm, bought shares worth nearly $2 billion in four Adani companies. This move signaled a vote of confidence in the group’s future prospects. Soon after, other major investors, including Qatar Investment Authority and UAE-based International Holding Company, followed suit, further bolstering Adani’s position.

Stock Price Soars, Inclusion in Benchmark Index Anticipated:

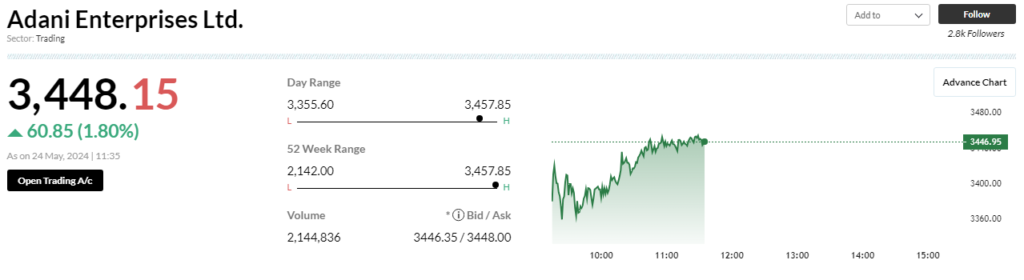

The positive sentiment surrounding Adani translated directly into its stock price. As the company demonstrated financial discipline and secured new ventures, investor confidence returned. The flagship company, Adani Enterprises, witnessed a steady rise in its stock price, recouping all the losses incurred due to the Hindenburg report. In fact, as of Friday, the stock price had nearly tripled compared to its lowest point in February 2023.

This impressive recovery has fueled speculation that Adani Enterprises might be included in the prestigious S&P BSE Sensex Index in June. Inclusion in this benchmark index would attract significant passive investment flows, further propelling the company’s growth.

Expansion Plans and Continued Growth:

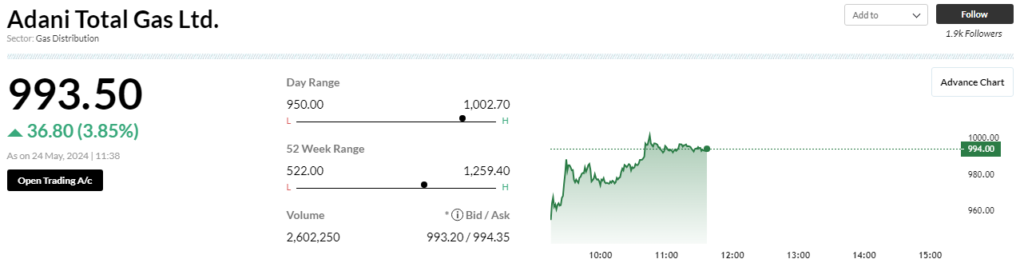

While Adani Enterprises basks in its recovery, other companies within the Adani Group are actively seeking fresh debt to fuel their expansion plans. The group has ambitious goals for its cement and copper businesses and is actively engaging with global investors to secure the necessary capital. This demonstrates the group’s unwavering commitment to growth across various sectors.

A Cautionary Tale and a Lesson in Resilience:

The Adani saga is a cautionary tale for investors. Short-seller reports can have a significant impact on stock prices, even if the allegations are unfounded. However, it also highlights the importance of strong corporate governance and a commitment to financial discipline. Adani weathered the storm by focusing on debt reduction, securing new projects, and regaining investor confidence.

The company’s remarkable recovery serves as a testament to its resilience and its ability to navigate challenging situations. As Adani continues to expand its presence across various sectors, its future remains bright, and investors will be keenly watching the group’s next steps.