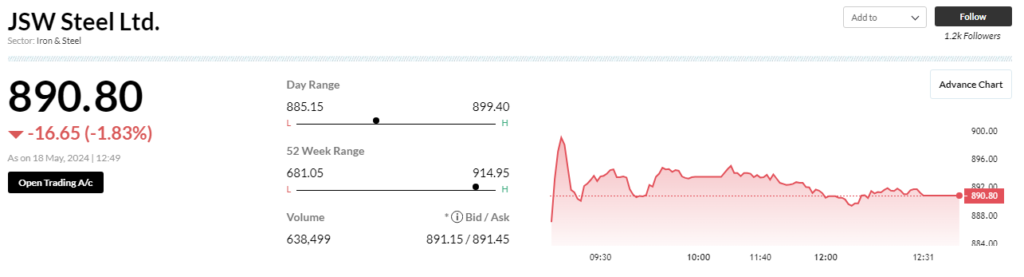

JSW Steel, a leading Indian steel producer, has seen its stock soar 17% in the past six months. This upward trend culminated in a 52-week high on Friday, just ahead of the release of their Q4 results after market hours. While the results revealed impressive production and sales growth, they were dampened by the impact of rising coal costs. Here’s a deeper dive into JSW Steel’s performance and what it means for investors.

Solid Growth in Production and Sales

JSW Steel delivered strong results on the production and sales front. Standalone sales volume in Q4 grew by a healthy 9% year-on-year, reaching 5.69 million tonnes (MT). This positive trend continued for the entire year, with total sales hitting 21.22 MT, representing an 8% increase compared to the previous year.

The company even surpassed its own production guidance, achieving a combined annual output of 26.68 MT, exceeding the target of 26.34 MT by a commendable 1%. Sales guidance was also met, showcasing the company’s ability to deliver on its promises.

Analysts Anticipate Continued Growth

Looking ahead, analysts are optimistic about JSW Steel’s production and sales performance. This optimism stems from several factors, including:

- Ongoing Expansions: JSW Steel is actively expanding its operations, which will translate to increased production capacity.

- Robust Domestic Demand: The demand for steel in India remains strong, providing a solid foundation for JSW’s domestic sales.

- Rising Export Opportunities: The global steel market presents promising export opportunities for JSW Steel to further boost its sales figures.

Analysts at Motilal Oswal Financial Services Ltd. (MOFSL) anticipate robust domestic volumes for JSW, fueled by their growing capacity, a strategic product mix, and the potential for increased exports.

Profitability Impacted by Coal Costs

Despite the positive sales and production figures, JSW Steel’s financial performance wasn’t without challenges. The overall picture was affected by fluctuations in steel and raw material prices.

Earnings Before Interest, Tax, Depreciation, and Amortization (EBITDA), a key measure of profitability, dipped by 15% sequentially. This decline can be attributed to lower sales realizations (the price at which they sell their steel) and the significant increase in coking coal costs. The consolidated reported profit for the quarter also suffered, dropping by 46% sequentially and a staggering 64% year-on-year. Analysts point to the $22 per tonne increase in coking coal costs during Q4FY24 as a major culprit for this decline.

Softening Coal Prices Offer Hope for the Future

Although the recent coal price surge impacted JSW Steel’s profitability, analysts remain positive due to the current trend of declining coal prices. MOFSL analysts predict a significant decrease in coal expenses for the upcoming quarter, with estimates suggesting a $22 to $27 per tonne reduction.

This projected drop in coal costs, coupled with stable steel prices and ongoing efforts to improve operational efficiency, is expected to positively impact JSW’s profitability in the future. MOFSL analysts have even revised their revenue and EBITDA estimates upwards, reflecting a 2% and 5% increase for FY25, with further growth of 4% and 7% projected for FY26.

Analyst View: Positive Outlook Despite Profit Dip

Despite the recent profit decline, analysts are largely bullish on JSW Steel’s future prospects. The strong production and sales performance, combined with the anticipated reduction in coal costs and ongoing efficiency improvements, paint a positive picture for the company’s profitability.

MOFSL analysts have even raised their earnings forecasts for the next two fiscal years, demonstrating their confidence in JSW Steel’s future.

Investment Decision: Consider Your Risk Tolerance

While this analysis highlights the positive aspects of JSW Steel’s performance and future outlook, it’s important to remember that the decision to buy, sell, or hold the stock ultimately rests with you, the investor.

Before making any investment decisions, it’s crucial to consider your own risk tolerance and investment goals. Conduct your own research, analyze current market trends, and factor in your individual financial situation before taking any action.

Additional Considerations for Investors

Here are some additional factors to keep in mind when evaluating JSW Steel as a potential investment:

- Global Steel Market Outlook: The overall health of the global steel market will significantly impact JSW Steel’s export opportunities and overall profitability.

- Government Regulations: Government policies and regulations regarding steel production and exports can influence JSW Steel’s operations and profitability.

- Competition: The competitive landscape of the Indian steel industry can affect JSW Steel’s market share and pricing power.

- Environmental Regulations: Increasing environmental regulations may necessitate investments in cleaner steel production technologies, impacting JSW Steel’s costs.

JSW Steel Beyond the Numbers

JSW Steel’s performance cannot be solely evaluated through financial metrics. Here are some other factors to consider:

- Sustainability Initiatives: JSW Steel’s commitment to sustainable practices can attract environmentally conscious investors.

- Innovation and Research & Development (R&D): The company’s focus on innovation and R&D can lead to the development of new, more efficient steel production methods and products.

- Corporate Governance: Strong corporate governance practices can foster investor confidence in JSW Steel’s long-term prospects.

Conclusion

JSW Steel’s Q4 results presented a mixed bag. While production and sales growth were impressive, rising coal costs negatively impacted profitability. However, analysts remain optimistic due to factors like declining coal prices, operational efficiencies, and strong domestic demand. The company’s ongoing expansions and focus on exports are further reasons for optimism.

The decision to invest in JSW Steel requires careful consideration of your risk tolerance, investment goals, and a thorough analysis of the factors mentioned above. By taking a comprehensive approach, you can make an informed investment decision regarding JSW Steel.